Seed Co: Inflation worry

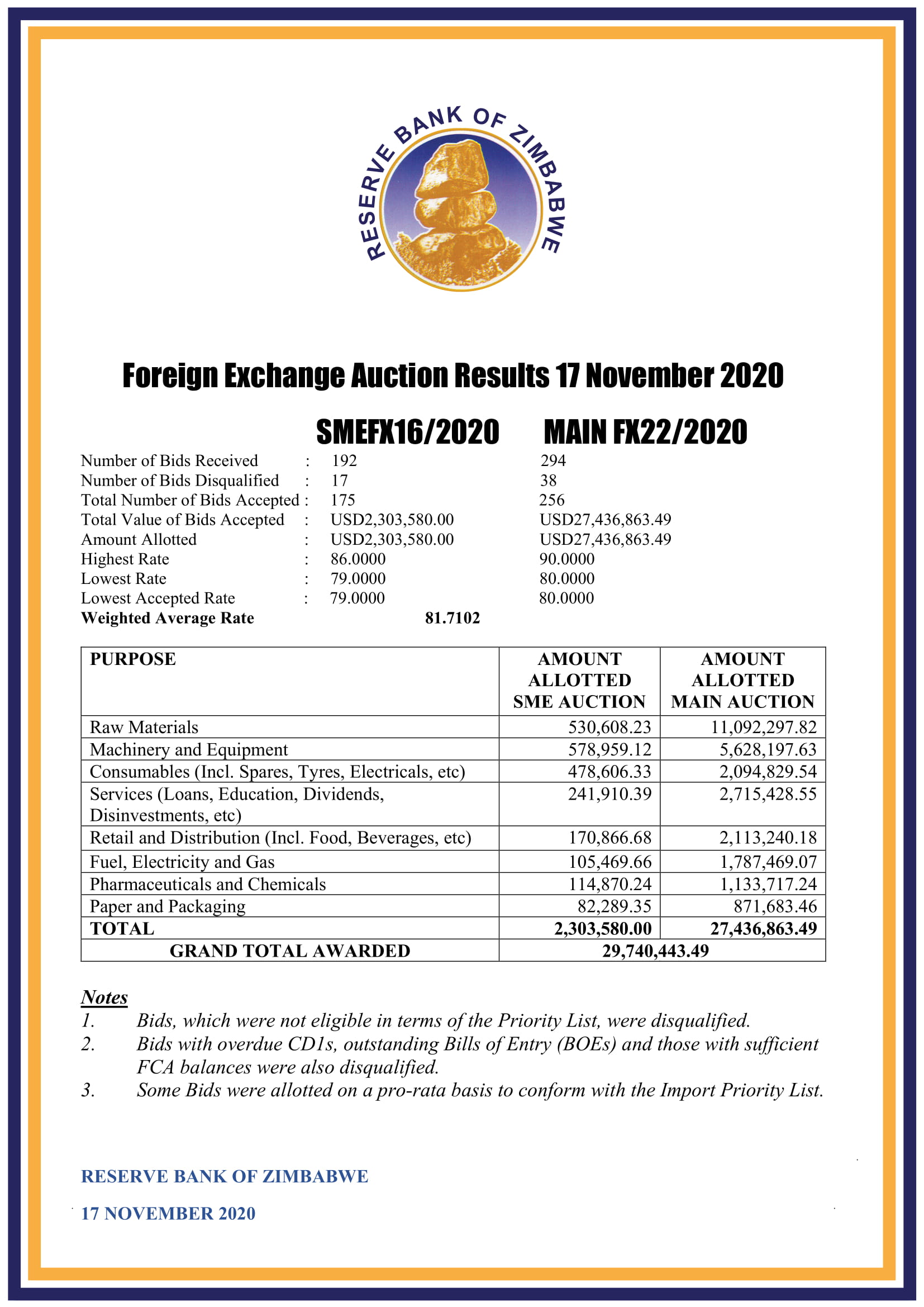

In August, the seed producer raised concern over the impact on prices: “Meanwhile, the introduction of the weekly foreign exchange auction saw the ZWL$ plummet from the previous fixed exchange rate of 25.0 to 57.4 per US$ at the initial auction held on 23 June 2020.” The company said it would ensure its prices track the exchange rate to minimise losses caused by the softening local currency.

BAT: time to exhale?

The cigarette maker imports the bulk of its raw materials, such as the special paper and filters. It says: “The foreign currency auction platform has opened access to foreign currency required for raw materials imports and has brought about stabilization of the exchange rate which will alleviate some of these challenging trading conditions.”

Turnall: Better planning

The construction materials producer says: “The operating environment for the third quarter improved due to the stability of the foreign exchange rate after the introduction of the foreign currency auction system. The prices for goods and services have relatively remained stable and this has enabled the business sector to improve the planning process.”

Masimba: building blocks

The construction company says: “The trading environment in the last quarter ended 30 September 2020 was largely stable supported by the Foreign Currency Exchange auction system and a contractionary fiscal policy. This, resultantly, contributed to the progressive reduction of month-on-month inflation and stability of prices of construction materials and services.”

Medtech: Bitter pill

The medical equipment supplier says the auction had the side effect of higher costs: “As anticipated, the price discovery process resulted in the local currency depreciating from a fixed rate of USD1: ZWL25 to USD1: ZWL81.44 as of 30 September 2020. This caused significant duty increases resulting in subdued demand. During that third quarter, the exchange rate had somewhat stabilised although the market remains distorted and operating expenses continued to reflect a premium to this rate.”

(156 VIEWS)

0 Comments